MAKE A MEME

View Large Image

| View Original: | Average US Federal Tax Rates 1979 to 2013.png (1036x556) | |||

| Download: | Original | Medium | Small | Thumb |

| Courtesy of: | commons.wikimedia.org | More Like This | ||

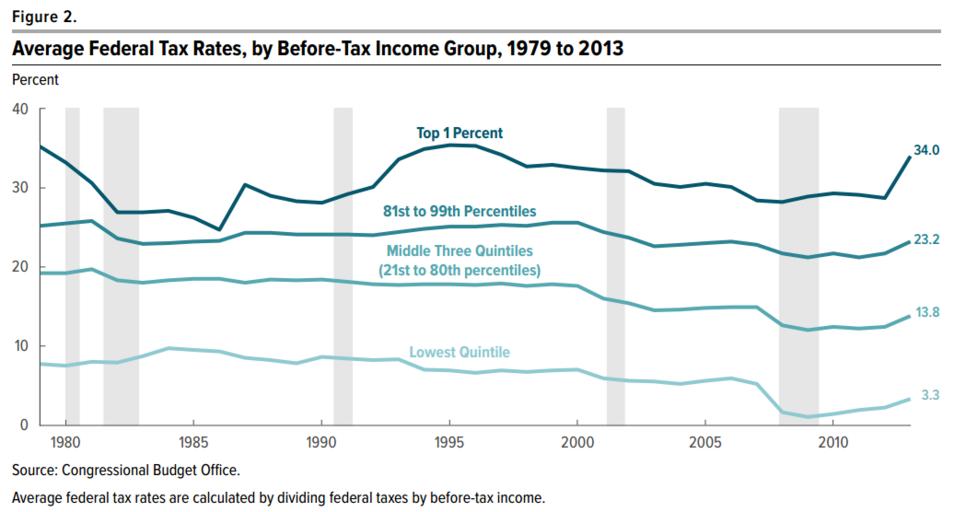

| Keywords: Average US Federal Tax Rates 1979 to 2013.png Understanding the chart President Obama's tax increases on the highest income taxpayers raised their effective tax rates for 2013 There were two primary increases Expiration of the Bush tax cuts of 2001 and 2003 for the top 1 of taxpayers income over 400 000 or 450 000 for married filing tax returns jointly Payroll tax increases on incomes over 200 000 roughly the top 5 as part of the Affordable Care Act Obamacare Uploaded with en wp UW marker 2014 01 06 December 2013 Chart from the US Congressional Budget Office depicting tax rates by income group from 1979 to 2010 and implications for tax rates based on 2013 law https //www cbo gov/publication/51361; prior version at http //cbo gov/publication/44604 2013-12-04 US Congressional Budget Office publication 44604 Taxes PD-USGov | ||||